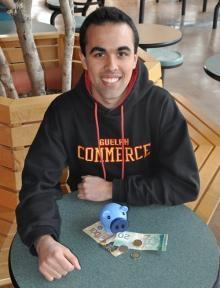

Josh Leyte-Jammu is proof that you’re never too old to have a piggy bank. It’s just one of the ways the fourth-year economics and finance student saves money.

“My parents got me a bank account when I was four and they’ve been teaching me everything there is to know about money since,” he says.

Leyte-Jammu is using his money sense to write a blog called Everyday Cents(www.everyday-cents.blogspot.com/ [1]). In the past two months, his blog received more than 1,000 hits. “The blog has been growing in popularity,” he says.

The blog is targeted at university students, but his financial advice is applicable to anyone. “Finance is one of those things that’s greatly overlooked by students and youth in general,” he says. The postings are often based on his personal experience with money, like how to save on textbooks.

“I’m a huge advocate of saving because I think there’s a massive savings deficit among our youth in Canada,” he says. The blog shows students how their spending habits can prevent them from saving. One of his most popular blog entries was called “Coffee or Your Cash.” He calculated that if a student buys a $2 cup of coffee each day for 60 days per semester for eight semesters, the total would be $960. Going out on weekends can burn an even bigger hole in students’ pockets, he adds. Spending $50 a week for 96 weeks would add up to $4,800.

Leyte-Jammu admits that he doesn’t always follow his own advice. “I’m equally guilty of a lot of these habits.” But that prompted him to write about his own financial mistakes so that others could learn from them.

He says that debt-ridden governments are partly to blame for consumers’ overspending because they aren’t setting a good example for their citizens and laments that we don’t even teach youth how to handle debt.

“I think it’s an absolute shame that we don’t have personal finance taught in this country at the secondary school level or even post-secondary for that matter.” Learning the basics of credit and debit cards, how to build savings and pay off debt could help students stay out of the red, he adds. Fear of the unknown often causes students to ignore their finances, but what they don’t know can hurt them.

Credit cards are financial traps for students, says Leyte-Jammu, describing credit card debt as “a very nasty type of debt to have.” Credit cards are too readily available to students who can’t afford them, he adds. If you make a $1,000 purchase, for example, and only pay the minimum monthly payment while the rest accumulates interest at a rate of 18 per cent, it will take 23 years to pay off the balance.

Debit cards also have a dark side. If you use an ATM that doesn’t belong to your bank, you will be charged a service fee by one or both banks. A $20 withdrawal could end up costing as much as $24, says Leyte-Jammu. He recommends using cash as much as possible because it’s easier to overspend invisible money using a credit or debit card.

The biggest financial mistake students make is not keeping track of their spending, he adds. “If you were to track your spending for one week, you would be absolutely amazed at what you truly spend your money on.”

Eating out can eat up a lot of money for students, who often use lack of time as an excuse for buying coffee or lunch instead of making it themselves. The reality is that students often spend more time and money waiting in line to buy coffee than if they brewed their own.

Leyte-Jammu’s financial resolutions for 2012 include preparing himself for the real cost of living after he graduates. Throughout his four years as a U of G student, he’s lived at home, a decision he made to save money. “I told myself when I started school that I wanted to have a certain amount of money put aside so that when I graduated, I would be in the black.”

His top three tips for students are to pay off their debt, especially credit cards and student loans; open a savings account, preferably one that’s tax-free; and track their spending.

By Susan Bubak